Form of Government:

In our form of government, seven members of council are elected by residents.

Elections are held in even numbered years and seats are staggered (i.e. 3 or 4 seats will be up for election every other year)

- As an example, 3 council seats were up for election in 2020 and 4 seats are up for election in 2022

After each council election, the newly constituted council appears on July 1st to “reorganize“.

At the reorganization meeting, all 7 council-members will choose form among themselves, a Mayor and two deputy mayors.

Not necessarily.

There is a commonly held belief that the individual elected with the highest number of votes should become mayor, but there is very little support for this in law or history.

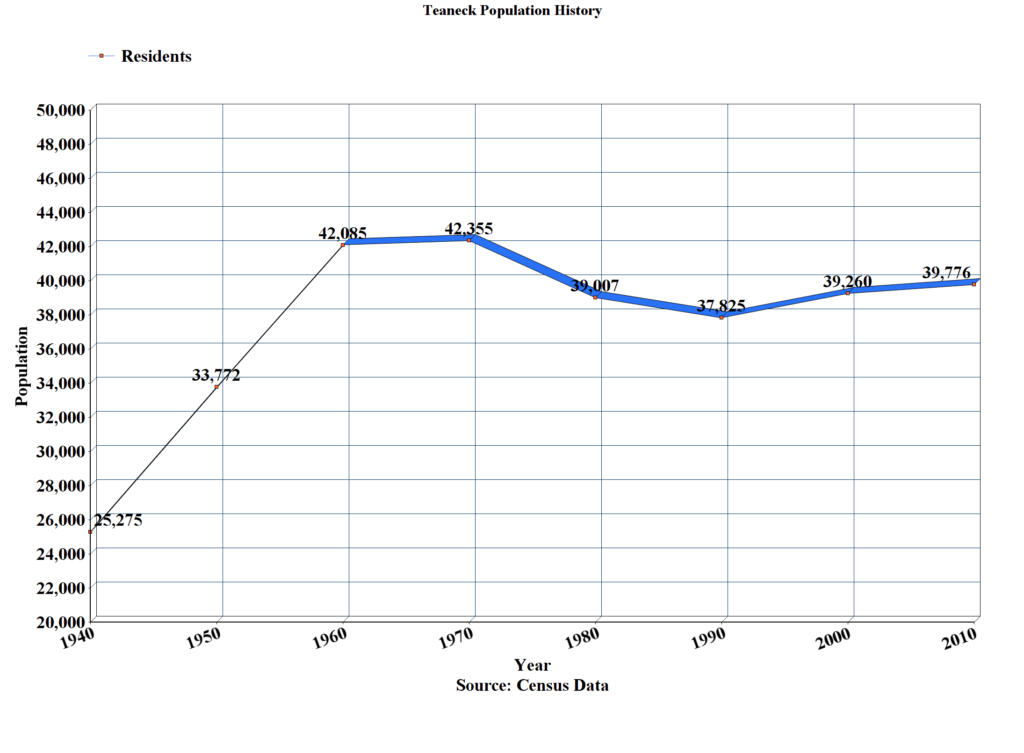

1930 to 1988

From 1930 when our Town adopted the Council-Manager form of government to 1988 (when we switched to the current Faulkner act), we elected 5 members of council, every 4 years, to serve for four year terms.

This is how the law worked back then:

- All members were elected in a single election.

- The council would try electing a Mayor from among themselves.

- If they couldn’t choose a mayor, the highest vote recipient would be chosen as mayor.

1988 to Present

In 1988, after a referendum was passed to proceed under the Faulkner Act, elections were staggered, so only a portion of the council would be elected every other year.

Because council members were not all chosen at the same time, this change made any determination of which member received the “highest number of votes” impossible.

Historical Evidence

May, 1966: In his address to the Township, Mayor Feldman lamented the lack of turnout in elections. He noted that in the 1960’s turnout dipped below 50% of registered voters and wondered what could be done to help halt the trend. In his speech, he referenced the issue of public misconceptions.

“I suspect that this bullet voting is motivated in large part by the commonly held belief that the high man in the voting is entitled to the post of mayor.”

– Matthew Feldman

In response, Councilman Henderson gave a brief historical record of the issue.

Councilman Henderson stated that “mention has been made of the fact that high man always received the vote for Mayor. In 1938, Mr. Van Wagner deferred to Mr. Votee, in 1946, Mr. Deissler who was high man voluntarily deferred to Mr. Clarence Brett, and the following term Mr. Brett was high man and voluntarily deferred to Mr. Deissler and Mr. Haggerty, third high man, was voted Deputy Mayor.”

When a resident later asked “if there was a written law on elected officials that the Councilman with the highest number of votes be elected Mayor“, Mayor Costa replied:

“It was not necessarily the Councilman with the highest number of votes.”

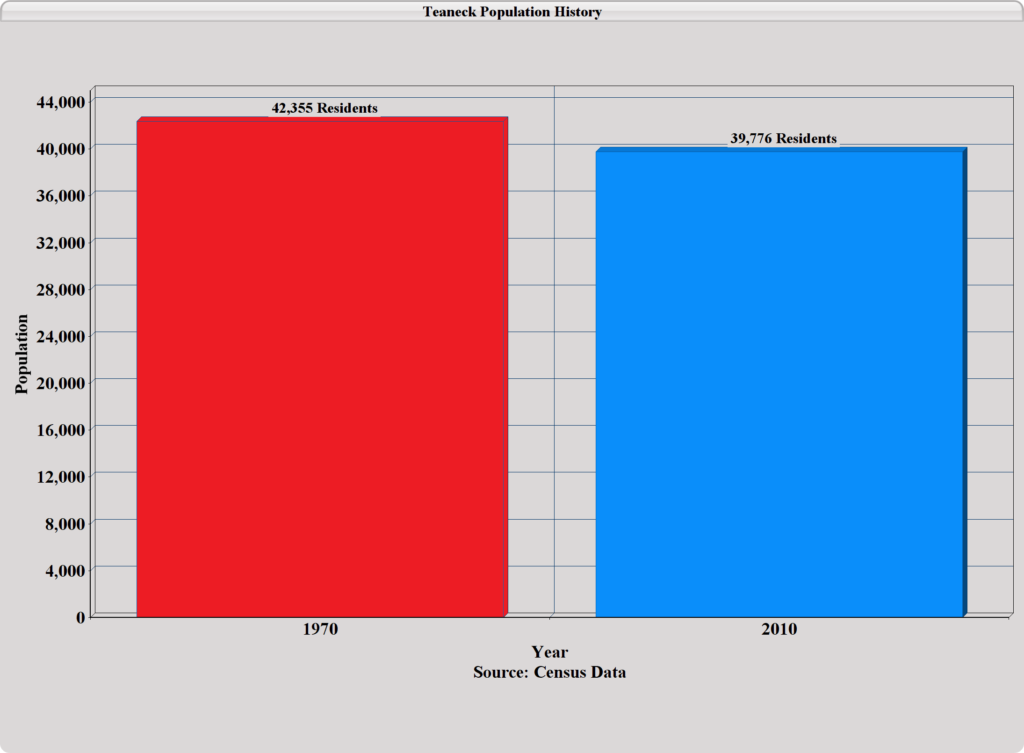

In the 1970, even before the 1988 referendum, we can see it was not the policy to elect the highest vote recipient as Mayor.

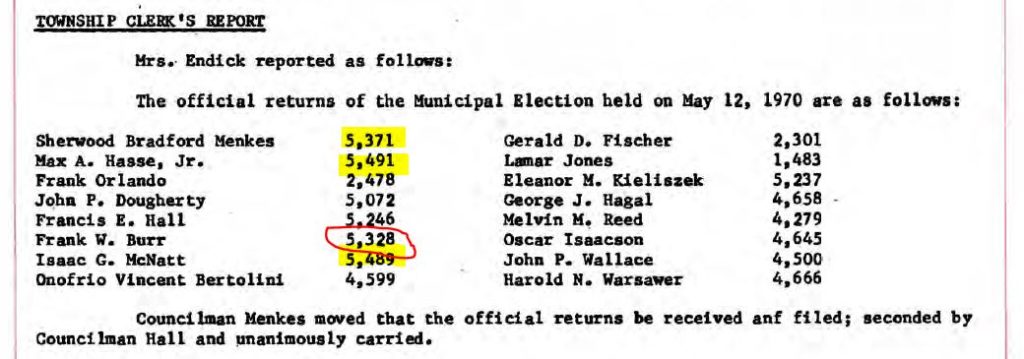

Here are the election results from the 1970 election:

Each of the highlighted council-members had a higher vote count than Mayor Burr.

So if someone tells you that the highest person should become Mayor, point them here.

Transparency:

Do you have a question you’d like answered? Email it to info@teanecktoday.com