One area which has a lot of people sharing misinformation is Municipal Bonding.

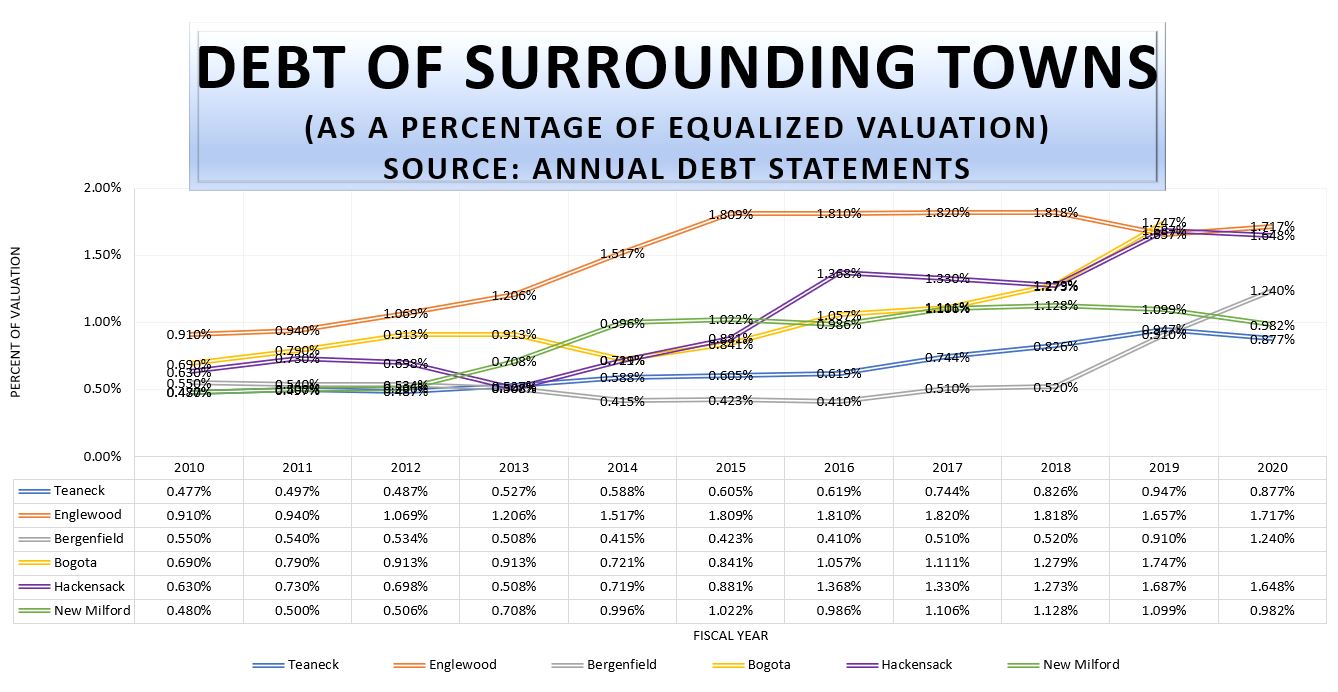

FACT: Teaneck’s Bonding Ratio is the lowest of neighboring municipalities (links to State numbers below).

Bonding or municipal debt is a terrific thing when used appropriately. The current council has one of the lowest bonding percentages compared with neighboring towns and comparisons to other parts of your tax bill show the benefits.

Let’s explain the basics:

For the following three projects, would you prefer the Town / BOE tax or bond the items?

- 5.35 miles of road repaving (cost is approx. $1M per mile)

- $5.35M for Renovation of Kindergarten Building & Admin Offices by Thomas Jefferson Middle School

Let’s start with some basic facts:

- Value of all land in Teaneck (as of 10/01/2020): $5,188,972,400

- Value of Average Residential Assessment: $387,405

- Percentage of total land value: .007466%

(stats from “User-Friendly budget” available on Township website)

Share of each $5.35M project for the average homeowner = $399.43

The $399.43 can be paid through the tax levy (all at once) or bonded (at near-zero interest) to be paid back over decades.

Bonding a project or paying for it through direct levy is a policy and financial decision that affects YOU!

So what would you prefer? Pay it all now or $19.97 a year for 20 years?

Let’s see how it works for two theoretical homeowners (you and a neighbor)

As you can see below, by bonding for roads, we pay them over time. If you choose to move, you only paid for the period you lived in Teaneck and used the item. But when the Kindergarten renovations and BOE Offices were taxed directly through the local levy, you paid all of it — in 2019 dollars, despite the fact you may not have intended to live here the following 20 years.

Interest Rates Matter

At a time of historic interest rates (near zero percent), we pay less over time than when we do lump sum levies.

That’s why bonding is often called intergenerational equity.

Note: the same situation exists in a slightly different variation for employee retirements. Generally, people are hired and retire over the course of years. But sometimes, many retire all at once, leading to an acute payout of vacation / terminal leave. When a larger-than-expected number of employees retire at once, a special State statute allows Teaneck to borrow at ZERO PERCENT interest from the State, and pay it back over five years.

So if multiple employees retire at once, Teaneck has a choice:

- collect the money from you now, before anyone retires and without any specific knowledge of when they will retire — or —

- collect the money over five years, if the situation happens

How much bonding is appropriate?

Of course, you don’t want to bond when it’s inappropriate to do so, so the State has a set of criteria and also created a way to compare towns in terms of their bonding levels.

How to compare:

Here’s how it works: each town adds up the value of the homes and land (assessed value), and the town can bond up to a percentage of that amount. Those percentages are prepared annually in a sworn document submitted by each town and sworn to by the Certified Financial Officer (CFO) of Teaneck.

The percentage can be found in the Annual Debt Statement section on the Township Website and the State let’s you look up every town here: Annual Debt Statement checker

So how do we compare?

- Teaneck (2021): .886%

Historic comparisons (with links to their debt statements) can be found below.

FACT: Teaneck leads surrounding areas in lowest percentage of debt

(expressed as a percentage of equalized valuation)

- Home #1: You’ve lived with your family for decades with plans to continue living in Town

- Home #2: Your neighbor moved out in 2020; a new neighbor moved in with a young family

Here’s how the bonding / taxation actually works out for you:

| You | Old Neighbor (moved away 2 yrs ago) | New Neighbor (moved in 2 years ago) | Which do you prefer? | |

|---|---|---|---|---|

| 5.35 miles of Road (cost ~$5.35M) | $19.97 per year (plus interest) | $19.97 per year (plus interest) | $19.97 per year (plus interest) | |

| Lacey School Renovation & BOE offices (by TJ) (cost ~$5.35M) | $399.40 (lump sum) | $399.40 (lump sum) | $0 | |

| First Year: | ||||

| Roads | $19.97 | $19.97 | $0 | |

| K renovation & BOE Offices | $399.40 (lump sum) | $399.40 (lump sum) | $0 | |

| Second Year | ||||

| Roads | $19.97 | $19.97 | $19.97 | |

| Years 3-20 | $19.97 for roads | $19.97 for roads | ||

| Totals: | ||||

| Roads: | $399.40 ($19.97 per year) | $39.94 ($19.97 per year) | $359.46 ($19.97 per year) | |

| K renovation & BOE Offices | $399.40 | $399.40 ($199.70 per year) | $0 ($0 per year) |

Next Up:

Combatting Misinformation: Stop & Shop / American Legion Drive

Click Here To See Notes- 40A:2-6. Debt limitation

No bond ordinance shall be finally adopted if it appears from the supplemental debt statement required by this chapter that the percentage of net debt as stated therein pursuant to 40A:2-42 exceeds 2.00%, in the case of a county, or 3 1/2%, in the case of a municipality. - 40A:2-41. Contents of annual debt statement

The annual debt statement shall be in form prescribed by the director and shall set forth as to the local unit:

a. Gross debt;

b. Deductions;

c. Net debt;

d. The equalized valuations of the taxable real estate, together with improvements, for the last 3 preceding fiscal years, and the average thereof;

e. Net debt expressed as a percentage of such average of equalized valuations; and

f. Any other information or detail required by law or by the director. The amount of any item which is indefinite or unascertainable may be estimated.

L.1960, c. 169, s. 1, eff. Jan. 1, 1962. Amended by L.1964, c. 72, s. 5.

One Reply to “Combatting Misinformation: Bonding”

Comments are closed.