What is the Glenpointe Tax Appeal?

The Glenpointe complex, consisting of Hotels, Offices, Atriums, parking lots and more appealed the assessment of their taxes for the years 2007 through 20101.

Had the Glenpointe prevailed, the Township would have been responsible for refunding over $15 million dollars.

[Note: $15M figure does not take into account tax appeals for years 2011 through 2018, which are included in the settlement agreed to by the parties]After the Superior Court found mostly for the Town, the appeals were ultimately settled for $8,083,000 (including interest).

From Judge Andresini:

(all quotes are fully explained below with relevant links to the opinion)

[T]he court rejects Plaintiff’s expert’s determination of stabilized revenue. Given that the Township’s expert’s stabilized ADR figures are in line with the actual ADR of the subject Hotel for the relevant tax years, did not overstate the effect of the economic downturn on those years, and are supported by the comparable data sets contained in the PKF trends he used, the court finds his stabilization of the subject Hotel’s revenues to be reliable and will adopt his conclusions of revenues accordingly.

Plaintiff’s expert’s stabilization resulted in figures significantly higher than the subject Hotel’s actual expense rates. For the same reasons as above, the court rejects Plaintiff’s expert’s stabilization of undistributed operating expenses and accepts the Township’s expert’s stabilization as valid and credible.

[T]he court again cannot adopt Plaintiff’s expert’s figures due to the flawed data set he utilized. Given that the court has held that the Township’s expert’s Upper-Upscale market data is more representative of the subject Hotel, and his determination is based on those sets, the court will adopt his insurance fee rate of 0.5% for each tax year.

For the reasons stated above regarding the credibility of Plaintiff’s valuation determinations, the court cannot accept Plaintiff’s expert’s conclusion of structural reserves. Given the testimony that the Township’s expert’s conclusion was based on his assessment of the quality and condition of the Hotel and his proper classification of the subject Hotel as Upper-Upscale, the court accepts his conclusion of 2% reserves as credible and will utilize his figures in its own valuation determination.

For the same reasons of lack of credibility as to the data sets utilized by Plaintiff’s expert with regard to his valuation conclusions for the subject Hotel, the court declines to accept his figures. As the court finds that the Township’s expert’s conclusion more credible, it will utilize his concluded Return On FF&E of $560,625 for each year.

Thus, the court finds the Township’s expert’s opinion as to the Return Of FF&E of 2.5%, or a total of $679,002 for tax years 2007 to 2009 and $615,628 for tax year 2010, to be credible and will adopt the same in its own valuation determination.

Plaintiff’s reliance on both the incorrect classification of the subject Hotel as well as an unpersuasive and unsubstantiated theory of risk renders his OARs untenable. The court agrees with the Township’s expert’s assertions… however… the court cannot accept the Township’s expert’s capitalization rate determination and will use its own judgment in concluding the appropriate rates.

What was the issue and why has it taken so long to resolve?

As discussed further below in the section on revaluation, our system of property tax relies on each property being assessed accurately. Each owner of land in Teaneck pays a portion of County, Local, Library, and Board of Education budgets. The amount of that portion is equal to the ratio between how much their land is valued vs the entire budget amount. Someone in a home worth $250,000 will pay half the property tax as someone in a home worth $500,000.

For businesses, the valuation also involves revenue projections and other metrics, but at the end of the day, the valuation amount determines the proportion of the tax those entities are required to pay.

Incorrect Valuations

Anyone can appeal the valuation placed on their property if they believe it is inaccurate2. In the case of Glenpointe, they filed appeals in 1988 – 1990 and another set in 2007-2010. This settlement deals with the 2007-10 appeals.

Residential vs Commercial

The valuation for homes is fairly straightforward. The valuation for something the size of Glenpointe is far more complicated. The resulting case has been in the Courts for nearly 14 years as a result of that complexity.

The Findings of Fact and Procedural History were made by the Superior Court on August 11th, 2020.

(the full Findings of Fact are appended to the end of this post as well)

What is the Glenpointe?

The subject property is comprised of two office buildings, a two-story atrium, a four-story parking garage, a 345-room hotel, and various parcels of vacant land located in Teaneck encompassing approximately 24.272 acres. (page 1)

The breakdown for the hotel is as follows:

- 100 Frank W. Burr Boulevard (Block 3606, Lot 5) – Hotel

- 200 Frank W. Burr Boulevard (Block 3606, Lot 2) – Glenpointe Center West Office

- 300 Frank W. Burr Boulevard (Block 3606, Lot 3) – Glenpointe Center East Office

- 400 Frank W. Burr Boulevard (Block 3606, Lot 4) – Atrium

- Frank W. Burr Boulevard (Block 3606, Lots 1 & 6, and Block 3604 Lots 13 & 14)

- 370 Glenwood Avenue (Block 3605, Lot 7) – Vacant Land

- 284 Oakdene Avenue (Block 4403, Lot 1) – Parking Lot

- West Office Building – 333,650 square feet

- East Office Building – 242,000 square feet

- Atrium – 76,000 square feet.

What did Glenpointe get assessed for?

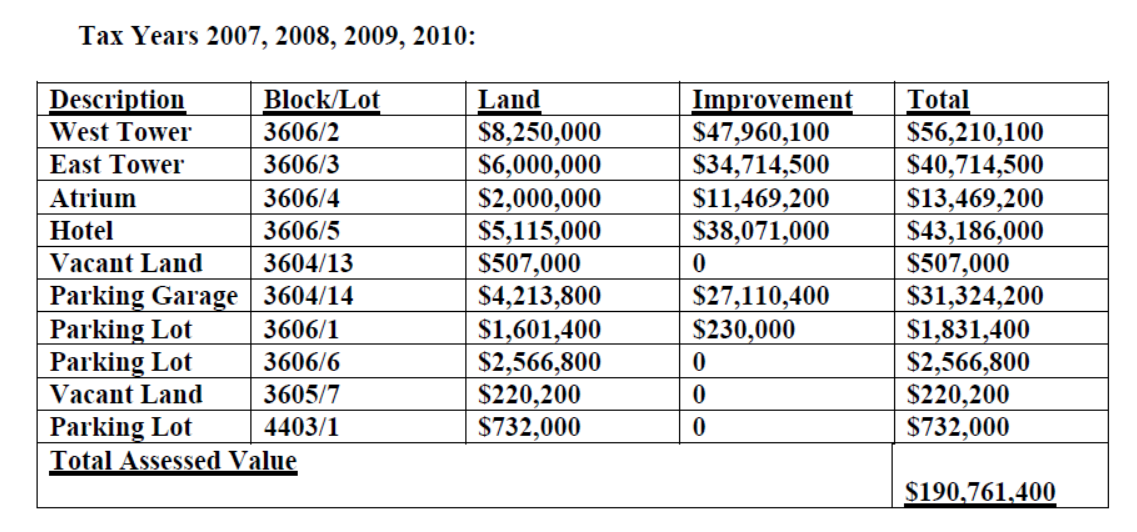

The full assessment for years 2007 through 2010 can be found here (page 3)

How does the Court determine the “true value”?

At trial, both parties offered real estate appraisers as experts, subpoenaed testimony and reports in support of their positions. The Court goes through a lengthy analysis which I won’t cover here, but for those interested in the income capitalization approach and why it’s the preferred method of estimating the value of income-producing property, it’s a thrilling read.

What did Glenpointe ask for?

This is a difficult question to answer exactly, as the particular arguments asserted by the parties, break the properties down by type, with various formulas asserted. As a proxy, we can see how they valued some of those components.

- The Office Complex (discussed by Plaintiffs on pp 4 to 11 and the Township on pp 11 to 18):

| 2007 | 2008 | 2009 | 2010 | |

|---|---|---|---|---|

| Glenpointe (total) | $84,335,000 | $84,180,000 | $81,778,000 | $80,755,000 |

| Teaneck (total) | $151,757,568 | $151,217,505 | $146,693,161 | $140,547,251 |

What did the Judge Decide?

Again, it’s a complicated decision, but the components show how the final number compares to the requested amounts.

| 2007 | 2008 | 2009 | 2010 | |

|---|---|---|---|---|

| Glenpointe (hotel) | $34,680,000 | $34,600,000 | $20,695,000 | $20,435,000 |

| Teaneck (hotel) | $50,459,300 | $52,754,900 | $49,642,000 | $43,538,100 |

| Teaneck (total original assessment) | $190,761,400 | $190,761,400 | $190,761,400 | $190,761,400 |

| Final (total assessment) | $180,072,700 | $180,757,700 | $165,003,900 | $161,777,200 |

(all numbers for all years are available below – this is meant for comparison purposes only)

Refunds by year:

- 2007: $229,807

- 2008: $219,781

- 2009: $587,529

- 2010: $674,752

The increase in refund amounts for 2009 and 2010 relates in large part to the economic downturn and its effects on the values of commercial properties.

Since part of the valuation of commercial businesses is based on Revenue, the economic downturn of 2008’s housing crisis and related drops in office usage, created one part of the request for the appeal.

- The parties stipulated to:

- Vacancy and collection loss rates for the entire Office Complex at 12.5% for each tax year and the total operating expenses for the Office Complex at $7,251,944.00 for each tax year. (page 2)

- Addition of $3,000,000 to the overall value of the ten separate lots relevant to the instant matter for tax years 2008, 2009, and 2010. (page 2)

Who won?

In all but one of the contested categories, the Judge sided with the town. In the final one, the judge developed an independent assessment.

The decision breaks up the component parts3:

(relevant language is highlighted here for the benefit of the reader)

Revenues:

When an expert’s opinion lacks a reliable foundation, supported by facts and objective market data, “the court cannot extrapolate value.” Inmar Assocs. v. Township of Edison, 2 N.J. Tax 59, 66 (Tax 1980). In accordance with the foregoing, the court rejects Plaintiff’s expert’s determination of stabilized revenue. Given that the Township’s expert’s stabilized ADR figures are in line with the actual ADR of the subject Hotel for the relevant tax years, did not overstate the effect of the economic downturn on those years, and are supported by the comparable data sets contained in the PKF trends he used, the court finds his stabilization of the subject Hotel’s revenues to be reliable and will adopt his conclusions of revenues accordingly.

Departmental Expenses

As the Township’s expert’s telecommunication and other expense figures were supported by credible data and the record, the court will adopt them in its final valuation determination accordingly.

Undistributed Operating Expenses

Both experts calculated their stabilized undistributed operating expenses in largely the same manner. However, as was the case with departmental expenses, Plaintiff’s expert’s stabilization resulted in figures significantly higher than the subject Hotel’s actual expense rates. For the same reasons as above, the court rejects Plaintiff’s expert’s stabilization of undistributed operating expenses and accepts the Township’s expert’s stabilization as valid and credible.

Insurance

Though both insurance rates concluded by experts are based on market data to establish appropriate rates where no actual data existed, the court again cannot adopt Plaintiff’s expert’s figures due to the flawed data set he utilized. Given that the court has held that the Township’s expert’s Upper-Upscale market data is more representative of the subject Hotel, and his determination is based on those sets, the court will adopt his insurance fee rate of 0.5% for each tax year.

Structural Reserves

Both experts made a deduction for the reserves set aside for repairs of structural elements of the building. For the reasons stated above regarding the credibility of Plaintiff’s valuation determinations, the court cannot accept Plaintiff’s expert’s conclusion of structural reserves. Given the testimony that the Township’s expert’s conclusion was based on his assessment of the quality and condition of the Hotel and his proper classification of the subject Hotel as Upper-Upscale, the court accepts his conclusion of 2% reserves as credible and will utilize his figures in its own valuation determination.

Return on FF&E

For the same reasons of lack of credibility as to the data sets utilized by Plaintiff’s expert with regard to his valuation conclusions for the subject Hotel, the court declines to accept his figures. As the court finds that the Township’s expert’s conclusion more credible, it will utilize his concluded Return On FF&E of $560,625 for each year.

Return of FF&E

Thus, the court finds the Township’s expert’s opinion as to the Return Of FF&E of 2.5%, or a total of $679,002 for tax years 2007 to 2009 and $615,628 for tax year 2010, to be credible and will adopt the same in its own valuation determination.

Capitalization Rate

Both appraisers utilized published studies as support for the estimates developed by the mortgage-equity technique; however, as stated above, Plaintiff’s reliance on both the incorrect classification of the subject Hotel as well as an unpersuasive and unsubstantiated theory of risk renders his OARs untenable. The court agrees with the Township’s expert’s assertions that the attractive nature of the property in comparison to other hotels in the market makes a lower capitalization rate most appropriate. However, for the same reasons stated above with regard to the capitalization rates utilized for the Office Complex portion of the subject, namely the arguments surrounding its mixed-use nature, the court cannot accept the Township’s expert’s capitalization rate determination and will use its own judgment in concluding the appropriate rates.

In addition to the years covered by the relevant appeals (2007 to 2010), the final settlement amount also covers the following years (2011 to 2018).

How does Revaluation work?

As I mentioned in-depth here, tax rates are floating modifiers. They work by taking the value of land, comparing it to the current budget, and obtaining the relative share from property owners. If your home is worth 2x that of your neighbor, you pay 2x as much in local taxes.

Everyone must pay their fair share, but since the value of homes and businesses is constantly in flux, at certain intervals, the town is required to find the full and fair value of the property.

You can read about the issue on the State website here: What is Revaluation

There is also an explanation of the programs and processes here: Appraisal Systems Inc – Revaluation

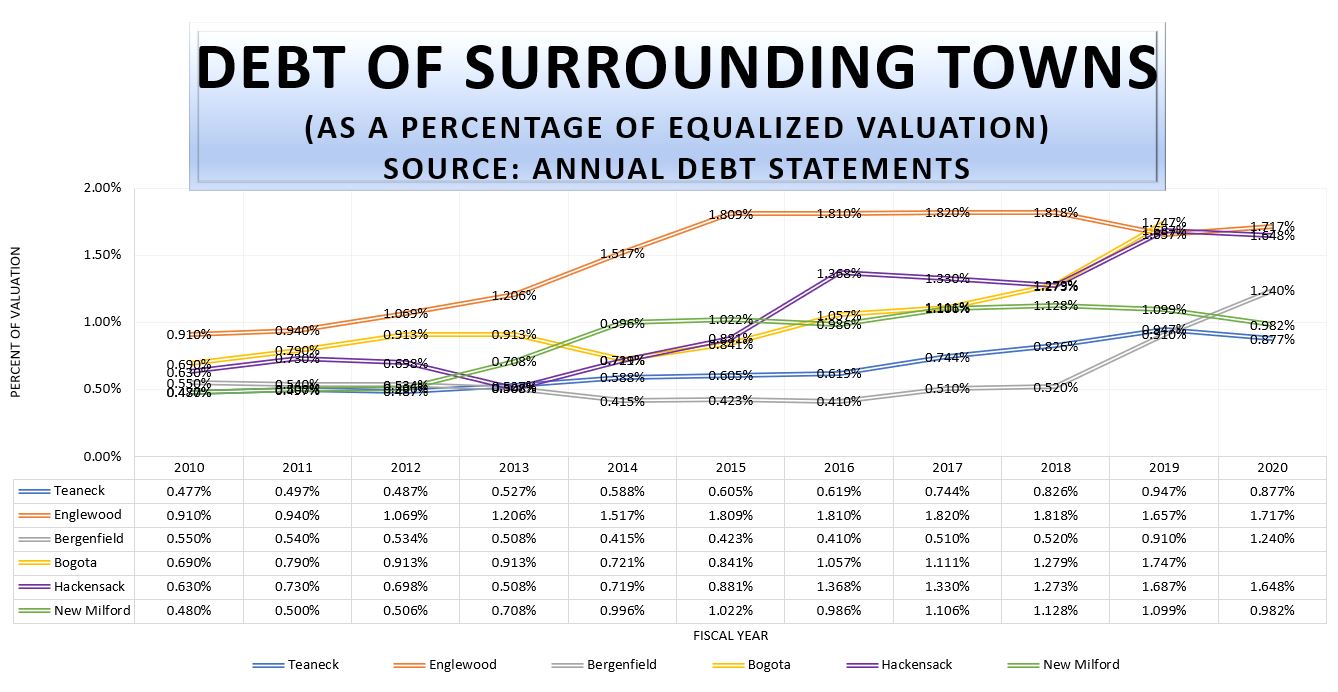

How is our Debt affected?

There are two parts to municipal debt/bonding: Authorized and Issued.

The amount of authorized debt is a very different amount than what is issued, so it’s important to know which numbers you are looking at when it comes to municipal debt. Issued debt can be used to not only compare historical data but also to compare your data across different municipalities.

Should we have been collecting since 2007 for this eventuality?

There’s no “right” answer to this question. If the township had been collecting and storing away millions of dollars for this appeal, that money would have come from you, the taxpayer. Bonding would have faced similar issues, as the tax rates in 2007 were certainly much higher than they are right now.

We will bond this money in 2021 at near-zero interest rates. The costs would have been much higher in 2007.

Municipal Bond Rate:

| 2007 | 2021 |

| 3.4% | 1.3% |

In terms of aggregate (adjusted) dollars collected, it would have been far more costly to bond this money in 2007, at a time when we didn’t know if the Judge would eventually accept the Town’s valuation, the Glenpointe’s valuation — or even which would be closer to the correct valuation accepted by the Court.

Had the Glenpointe prevailed, the Township would have been responsible for refunding over $15 million dollars. And it’s worth noting, that the $15M figure does not take into account eventual appeals for the years 2011 through 2018, which are included in the settlement agreed to by the parties.

Opinions of elected representatives at the time (and throughout the period of the appeal) have varied.

At the March 10, 2015 council budget meeting including the Glenpointe appeals, [then] councilman Sohn “express[ed] understanding of the Manager’s and Chief Financial Officer’s concerns to have adequate funds in surplus but… recommended arriving as close to zero, as possible.”

Meanwhile, [then] “Councilman Hameeduddin expressed that the Township could bond to pay the Glenpointe tax appeal.” (page 4 of minutes of 3/10/15)

How does this affect our Debt?

As mentioned here, the township is in one of the best positions when it comes to debt (when compared to our neighbors). The numbers will shift slightly, and specific amounts are not available. I will provide them and update the post when they come out.

Information about the Debt Limit

In the State of New Jersey, municipalities may bond up to the debt limit, which is 3.5% of the equalized valuation of taxable real estate.

The annual debt statement, allows you to compare historical as well as neighboring municipalities’ percentage of authorized debt, against each other.

You can read more about debt rates here:

How does Teaneck compare to surrounding areas in terms of bonding?

Still have questions?

Leave a comment below

- Cases 004987-2007; 004989-2007; 004982-2007; 04984-2007; 004992-2007; 002967-2008; 002975-2008; 002977-2008; 002982-2008; 002987-2008; 001623-2009; 001639-2009; : 001638-2009; 001640-2009; 001642-2009; 017684-2009; 002077-2010; 002080-2010; 03183-2010; 003198-2010; 003207-2010; 020410-2010 were consolidated into 020410-2010 before Judge Andresini.

- Note that there are some legal requirements as to how much the valuation must be off, and this is not meant to be a legal treatise. You should consult an attorney if you feel an appeal is warranted.

- Areas that were stipulated are contained in the decision but not highlighted here as the parties were in agreement

Excellent summary. But what I don’t understand (I must be missing something) is if the judge accepted the townships position on every issue but one, and on that one he rejected both side’s positions, why was the settlement 50% of what Glenpointe was seeking? That sounds very high. What am I missing?

Excellent summary.

Thanks.

…if the judge accepted the townships position on every issue but one, and on that one he rejected both side’s positions, why was the settlement 50% of what Glenpointe was seeking?

The suits themselves stemmed from years 2007 to 2010. The settlement though, goes through 2018.

I posted the raw numbers at the bottom.

The refunds related to the litigation are:

2007: $229,807

2008: $219,781

2009: $587,529

2010: $674,752

Total for 2007-10: $1,711,869 (plus interest)

It’s probably also worth noting that the total valuation went from $190,761,400 to $180,072,700 (for 2007).

For comparison, a similar appeal would see a house valued at $460,500 going down to $434,700 (6%).

As you can see, the economic downturn post-2008 housing crisis, had an effect on valuation as well. Otherwise, the refund could likely have been even less for those years.