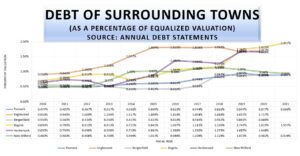

How does Teaneck compare to surrounding areas in terms of bonding?

In the State of New Jersey, municipalities may bond up to the debt limit1, which is 3.5% of the equalized valuation2 of taxable real estate.

In plain English: each town adds up the value of all their land, buildings, etc… averaged over last three years. The limit they can bond is 3.5% of that number. And since the amount each town can bond is relative to their individual valuations, you get a metric that can be compared.

The annual debt statement, allows you to compare neighboring municipalities’ percentage of authorized debt, against each other.

(The data below are pulled from the authorized debt statements submitted to the State)

Here’s how Teaneck looks, based on the submitted annual debt statements from Bergenfield, Bogota, Englewood, Hackensack and New Milford

click to enlarge

Click here to see a chart of the Annual Debt statement percentages for each municipalityEach link below will bring you to the Annual Debt Statement, filed under oath with the State of New Jersey.

| Year | Teaneck | Englewood | Bergenfield | Bogota | Hackensack | New Milford |

|---|---|---|---|---|---|---|

| 2020 | 0.877% | 1.717% | 1.24% | 1.648% | 0.982% | |

| 2019 | 0.947% | 1.657% | 0.910% | 1.747% | 1.687% | 1.099% |

| 2018 | 0.826% | 1.818% | 0.520% | 1.279% | 1.273% | 1.128% |

| 2017 | 0.744% | 1.820% | 0.510% | 1.111% | 1.330% | 1.106% |

| 2016 | 0.619% | 1.810% | 0.410% | 1.057% | 1.368% | 0.986% |

| 2015 | 0.605% | 1.809% | 0.423% | 0.841% | 0.881% | 1.022% |

| 2014 | 0.588% | 1.517% | 0.415% | 0.721% | 0.719% | 0.996% |

| 2013 | 0.527% | 1.206% | 0.508% | 0.913% | 0.508% | 0.708% |

| 2012 | 0.487% | 1.069% | 0.534% | 0.913% | 0.698% | 0.506% |

| 2011 | 0.497% | 0.940% | 0.540% | 0.790% | 0.730% | 0.500% |

| 2010 | 0.477% | 0.910% | 0.550% | 0.690% | 0.630% | 0.480% |

Click Here To See Notes

- 40A:2-6. Debt limitation

No bond ordinance shall be finally adopted if it appears from the supplemental debt

statement required by this chapter that the percentage of net debt as stated therein

pursuant to 40A:2-42 exceeds 2.00%, in the case of a county, or 3 1/2%, in the case of a

municipality. - 40A:2-41. Contents of annual debt statement

The annual debt statement shall be in form prescribed by the director and shall set forth as

to the local unit:

a. Gross debt;

b. Deductions;

c. Net debt;

d. The equalized valuations of the taxable real estate, together with improvements, for

the last 3 preceding fiscal years, and the average thereof;

e. Net debt expressed as a percentage of such average of equalized valuations; and

f. Any other information or detail required by law or by the director. The amount of any

item which is indefinite or unascertainable may be estimated.

L.1960, c. 169, s. 1, eff. Jan. 1, 1962. Amended by L.1964, c. 72, s. 5.