A Sixth Straight ZERO

The 0% tax levy was the result of proper management, and was made possible, in large part by Council’s use of smart development, which maintains the quality of life Teaneck expects.

But, my taxes went up!

I get it – mine went up too. But the tax bill you receive has a few different parts and not all of them have been going up.

So, let’s break down what is happening.

Breaking down your bill

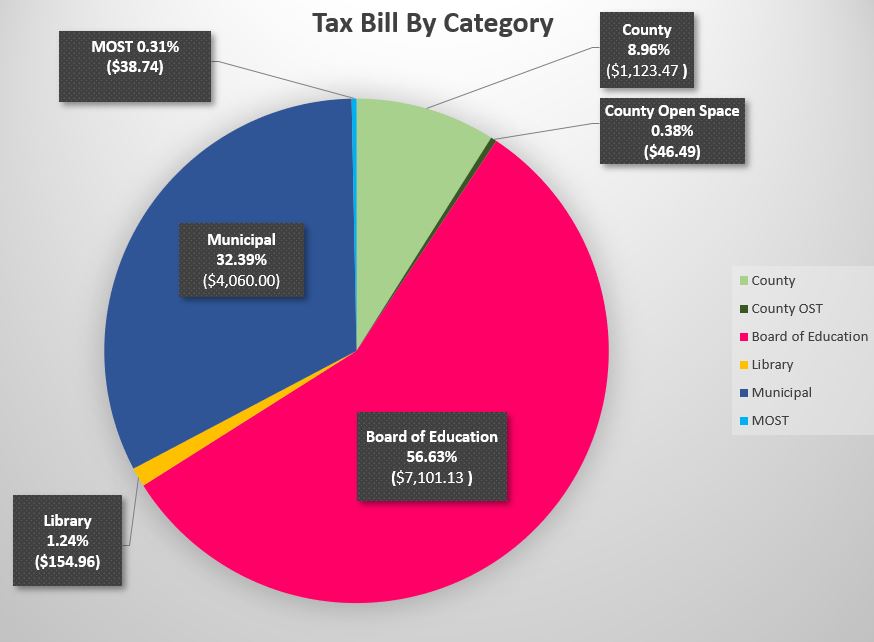

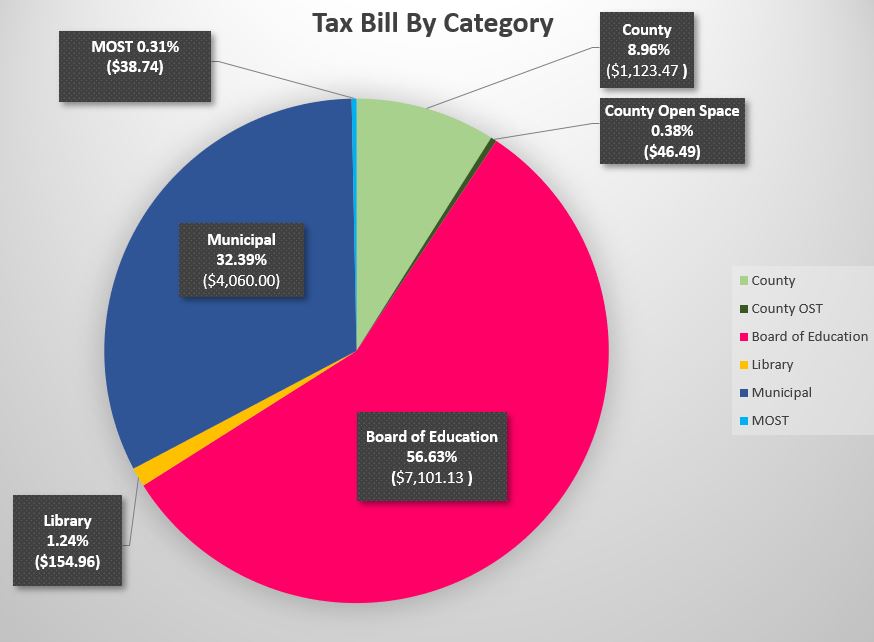

The tax bill each home receives has a few parts. Here is an example for the average Teaneck home:

The average residential assessment for 2019 was $384,308.15.

The average residential assessment for 2019 was $384,308.15.

- Municipal portion: $4,039.08

- Board of Education Portion: $6,979.04

*** Click here to see how the bill breaks down in each category ***:

The tax bill for the average assessment breaks down as follows (approx):

| Board of Education | 56.8% | $6,979.04 |  |

| Municipal | 32.87% | $4,039.08 | |

| Municipal Open Space | .31% | $38.43 | |

| County | 8.48% | $1,041.48 | |

| County Open Space | .31% | $38.43 | |

| Library | 1.22% | $149.88 |

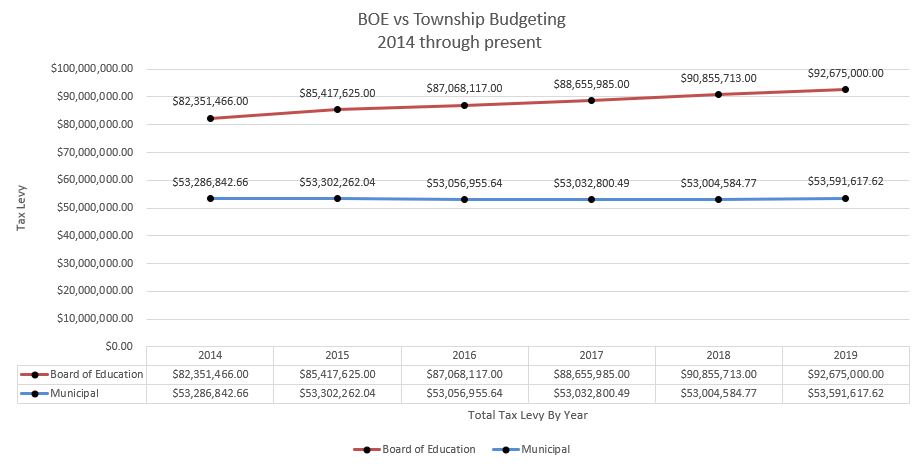

Municipal and BOE Portions

- The municipal portion of the tax bill is controlled by the Township Council and the Board of Education portion is controlled by the School Board.

Here is what the Township (municipal) and BOE budgets have looked like over the last have decade+:

What could it have been without a Zero-Budget?

Municipalities are constrained to operate within a possible increase of 3.5% over the previous year’s tax levy. (see NJSA 40A:4-45.14 Permissible increase in appropriations)

What would tax rates look like if Teaneck increased them on the municipal side instead of fighting for a zero?

The chart below shows what the budget levy has been for each year in the graph above. The “Cap Bank” represents what we could have increased the levy by, had we gone to the full 3.5%.

Each of the links goes to the Ordinance that shows the amount in the “cap bank”.

By remaining at a ZERO budget levy increase, the Township Council has kept the municipal portion of your tax bill flat. Note: Others portions of your bill may have increased, however.

| Year | Budget | Cap Bank | Link |

| 2020 | $54,012,908 | $2,067,879 | 11-2020 |

| 2019 | $53,591,618 | $2,022,909 | 15-2019 |

| 2018 | $53,004,585 | $2,025,023 | 7-2018 |

| 2017 | $53,032,800 | $1,946,929 | 9-2017 |

| 2016 | $53,056,956 | $1,972,735 | 8-2016 |

| 2015 | $53,302,262 | $1,949,474 | 18-2015 |

| 2014 | $53,286,843 | $1,916,714 | 24-2014 |

| Totals | $13,901,664 |

The Average Homeowner:

For the Average assessed home in Teaneck, this would have meant an additional $1,047 in municipal taxes per year.

Instead, the Township Council introduced a 6th straight year of ZERO-PERCENT tax levy increases for 2020.

Related: Bonding

In addition to the yearly tax bill, the Township also issues debt for road, building or other capital expenditures. To see how we have been doing with regards to controlling our debt levels, you can click below and see where we stand, as well as a comparison to other towns around us.