A Review of Teaneck Public School Filings Show District Overcharged Taxpayers on Several Budgetary Items, including Transportation and Security

Security

Despite significant security issues (including the removal of security guards and threats against schools), the Teaneck Public School District collected 100% of its security budget from taxpayers… but didn’t spend 25% of it. Where did it go?

Busing / Transportation

Despite complaints about the cost of busing and the inability to meet required busing needs, records show that the District collected FAR IN EXCESS of what it spent on busing. In fact, in the last 3 years alone, the District pocketed $3M into “Fund Balance” to use as surplus funds… all from our tax dollars.

What is happening within the Teaneck Public School Budgets?

25% of the District Security budget went to discretionary fund balance?

Over $3M in local taxes set aside for busing students, instead went to discretionary fund balance over the past 3 years?

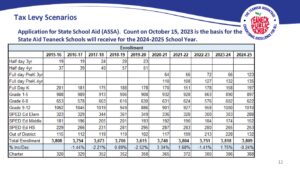

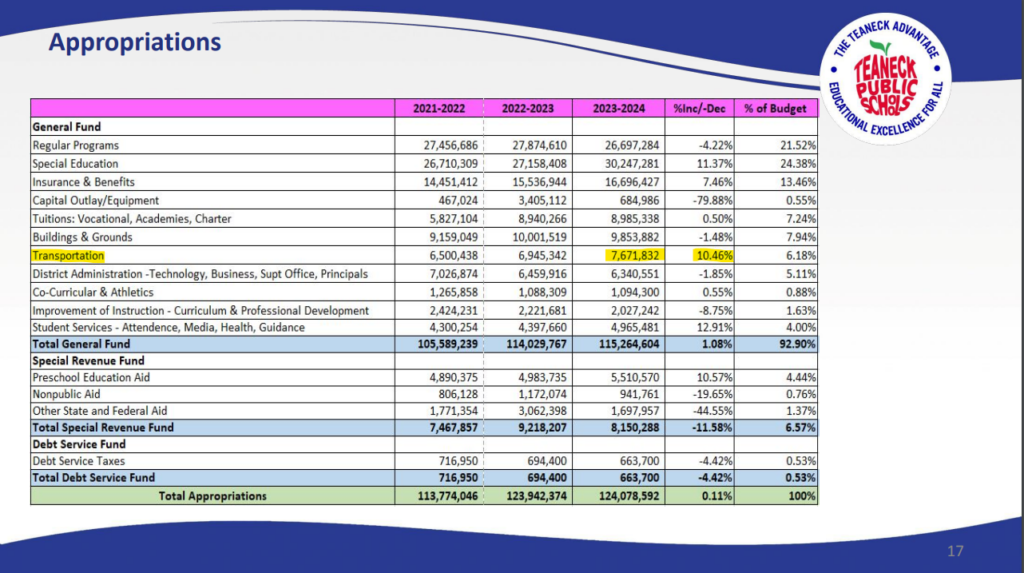

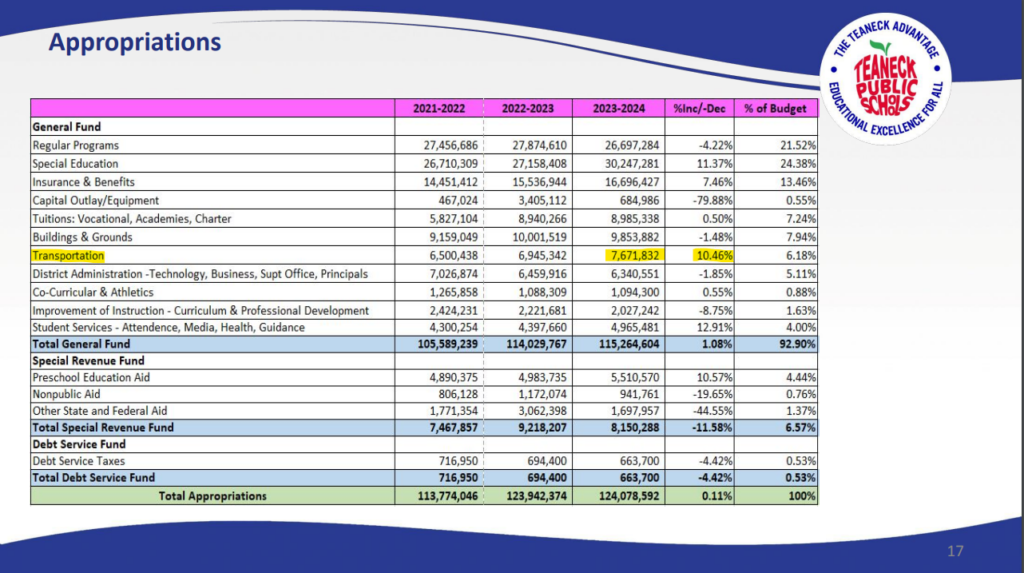

2022/23: Teaneck Schools – $6.94M ALLOCATED for Transportation

2022/23: Teaneck Schools – $5.73M ACTUALLY SPENT for Transportation

2023/24: Teaneck Schools – $7.67M, a 10.46% RAISE to the Transportation Tax Levy, for an unprecedented $7.67M bill to taxpayers.

You read that right — after pocketing $3M in local tax levy funds from residents that we were told would be used for busing & transportation, the line item for busing in 2023-24 WENT UP AGAIN by 10.46% to $7.67M according to the 2023-24 Final Budget presentation,

How could that be possible?

A few days after scores of parents attended a Board of Education meeting asking about the lack of security, I found myself asking these questions to the Teaneck School District Business Administrator.

The ACFR (Annual Comprehensive Financial Report)

The Annual Comprehensive Financial Report (ACFR) is a set of U.S. government financial statements comprising the financial report of a state, municipal or other governmental entity that complies with the accounting requirements promulgated by the Governmental Accounting Standards Board (GASB).

“Exhibit C” of the ACFR contains “Budgetary Comparison Schedules”.

These schedules indicate the:

- Final amount of the budgeted line item

- Actual amount spent for the budgeted line item

- Variance, or difference in the final amount budgeted and what was actually spent

Here are some examples from the ACFR”

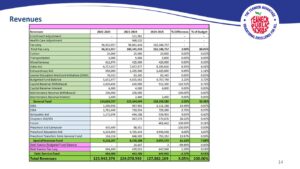

| Final Budget | Actual Spent | Variance (Difference) | Year |

| Total Student Transportation Services | $6,069,994 | $4,489,077 | $1,580,917 | 2021 |

| Total Student Transportation Services | $6,499,755 | $5,736,648 | $763,107 | 2022 |

| Total Student Transportation Services | $5,706,667 | $4,975,660 | $731,007 | 2020

|

| Total: | $18,276,416 | $9,464,737 | $3,075,031 | |

| Final Budget | Actual Spent | Variance (Difference) | Year |

| Total Security Budget | $1,134,695 | $855,873 | $278,822 | 2022 |

| Total Security Budget | $383,161 | $383,161 | $0 | 2020 |

| Total Security Budget | $548,073 | 545,723 | $2,350 | 2021

|

| | | | |

ACFR Data (available on NJ State Website):

Confirmation

I reached out to the District’s Business Administrator to confirm these findings.

My email appears below:

While the difference between Final Budget and Actual is fairly small for many categories (e.g. Total instruction, which comes in at 5%), other categories seem to have a very different variance betweenfinal budget and actual expenditures.

As an example….

Security:

The original budget is listed as $516,101.00

The final budget is listed as $1,134,695.00 with $618,594.00 under “transfers”

The actual is listed as $855,873.00, leaving a variance of $278,822.00

The variance would appear to be 25% of the final budget amount.

If that’s the case, did the variance go to fund balance?

Am I missing something here?

Appreciate any feedback you can provide.

Keith

The response from the Business Administrator came on 10/19/2023:

Haqquisha Taylor <htaylor@teaneckschools.org>

Thu, Oct 19, 2023 at 4:45 PM

To: Keith Kaplan <keith@teanecktoday.com>

Cc: Andre Spencer <aspencer@teaneckschools.org>

Good Day,

Thank you, Mr. Kaplan, for your patience and for your follow up. The answer to your question regarding the variance listed in the 2021-2022 ACFR for Security is yes, the variance goes to fund balance. For Capital, $388,328 of the variance goes to fund balance. The remaining $18,600 of variance, relating to Facilities Acquisition and Construction Services, is returned to the Capital Reserves.

Let me know if I can be of further assistance.

Where did the money GO?

This is a tricky question, as once you put massive amounts of money into “surplus”, it can be spent in a discretionary manner across different expense categories.

Obviously, as per the Business Administrator, we can see that the 25% of last year’s “Security Budget” which went unused was disbursed as follows:

- $388,328.00 to “Capital”

- $18,600.00 to “Facilities Acquisition and Construction [sic] Services”

If you recall, Teaneck Schools spent $5.35M for Renovation of a Kindergarten Building (from Eugene Field School office space to the current Lacey School) & Admin Offices by Thomas Jefferson Middle School.

Where did an “extra” $5,300,000.00 come from without bonding? Now you know.

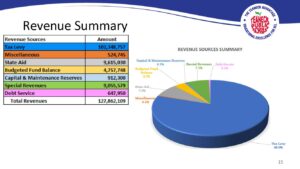

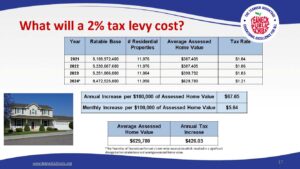

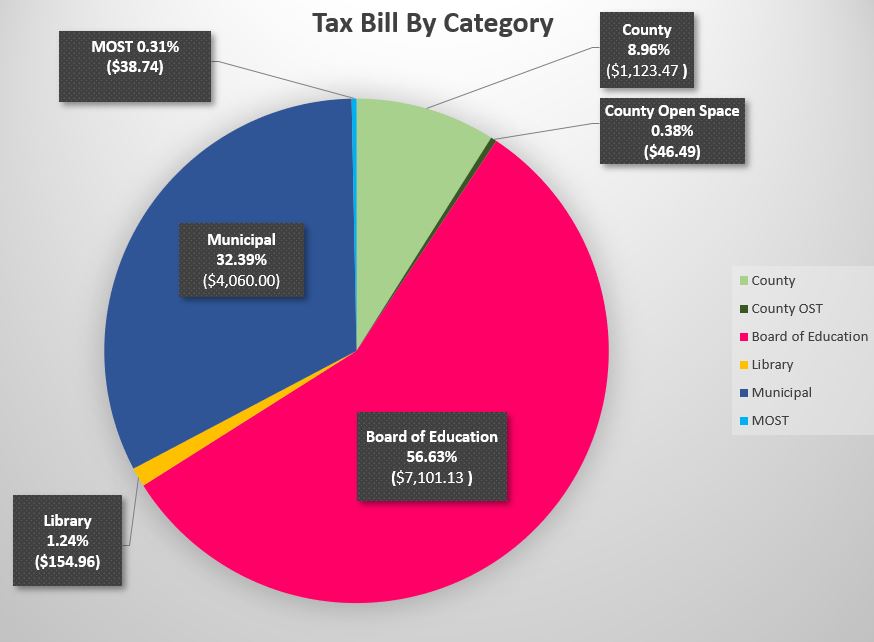

Let’s start with some basic facts:

- Value of all land in Teaneck (as of 10/01/2020): $5,188,972,400

- Value of Average Residential Assessment: $387,405

- Percentage of total land value: .007466%

(stats from “User-Friendly budget” available on Township website)

Share of each $5.35M project for the average homeowner = $399.43

The $399.43 can be paid through the tax levy (all at once) or bonded (at near-zero interest) to be paid back over decades.

Bonding a project or paying for it through direct levy is a policy and financial decision that affects YOU!

So what would you prefer? Pay it all now or $19.97 a year for 20 years?

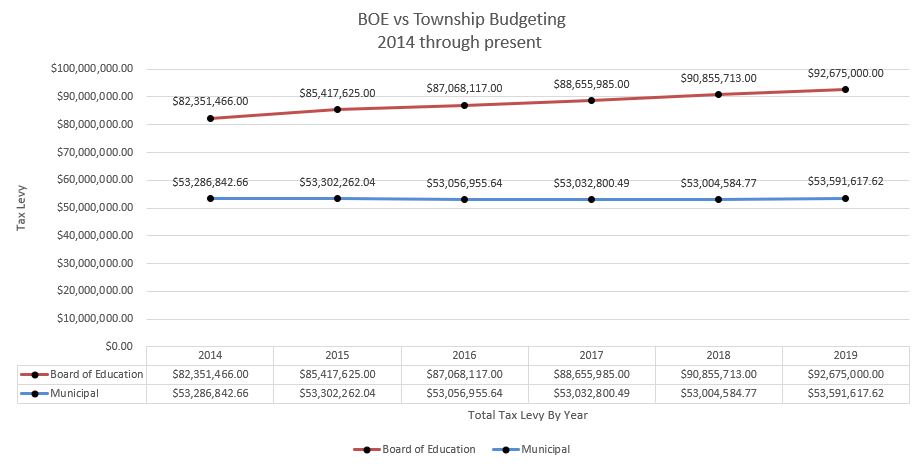

This is NOT how schools are supposed to operate. Here’s why:

If you were to move out of Teaneck today, you would have paid 100% of your share of the $5,300,000.00. But had this been bonded, at historically low rates over 30 years, you would only pay a share of the amount that corresponded with your time living in Teaneck.

The new resident moving in would continue to pay their fair share.

That’s how bonding – which is sometimes called “generational equity” – works.

But to do that, the Schools would have to go to the public with a bonding referendum on a ballot. And the fear is that the public would vote down a bonding referendum because they think the schools ALREADY have enough money. So rather than chance a defeat (which also acts as a barometer on resident satisfaction with the district), they inflate certain line items, year after year after year, in order to have you, the taxpayer pay MORE THAN YOU NEED to ensure a free and appropriate public education.

This is NOT how schools should function and the public should be incensed at how they are treating us at the Teaneck BOE.