It’s “Silly Season” again when people start thinking up scurrilous attacks to throw around.

First, out of the gate, this year goes to Margot Embree Fisher through the local chapter of LWV of Teaneck, where she sits in violation of the by-laws of her own organization:

[It’s a shame that an organization with such a wonderful national presence has been reduced to sniping like this on the local level, but here we are]

The LWV Teaneck chapter sent a letter (see pdf below) to the Bergen County clerk claiming that last November Councilmember Keith Kaplan “was inside and outside of the Rodda Center polling place “for much of the early voting week” and that he “was talking with voters and handing out business cards inside the 100-foot boundary set for purposes of preventing electioneering.”

Of course, he was.

Residents at the time were writing me and other council members personally and posting all over social media about — all sorts of problems — they were having with the new touchscreen voting machines. So he and others went to see what was going on and talk to the people running the show.

Councilman Kaplan met with Howard Cramer, the representative from Dominion Voting and he gave out his card (link). Kaplan gave him back his own. We also met with the head of Bergen County’s Board of Elections, Richard Miller. He too gave us his card and we gave him one of ours. Knowing the rules, if a resident asked to speak with one of us, we told them it wasn’t the right place to talk about such things, but they could email and we could talk another time. I gave them a business card too.

These are intimidation tactics now?

Maybe the local LWV is just so successful they routed out all nefarious conduct?

But that’s not true, you see!

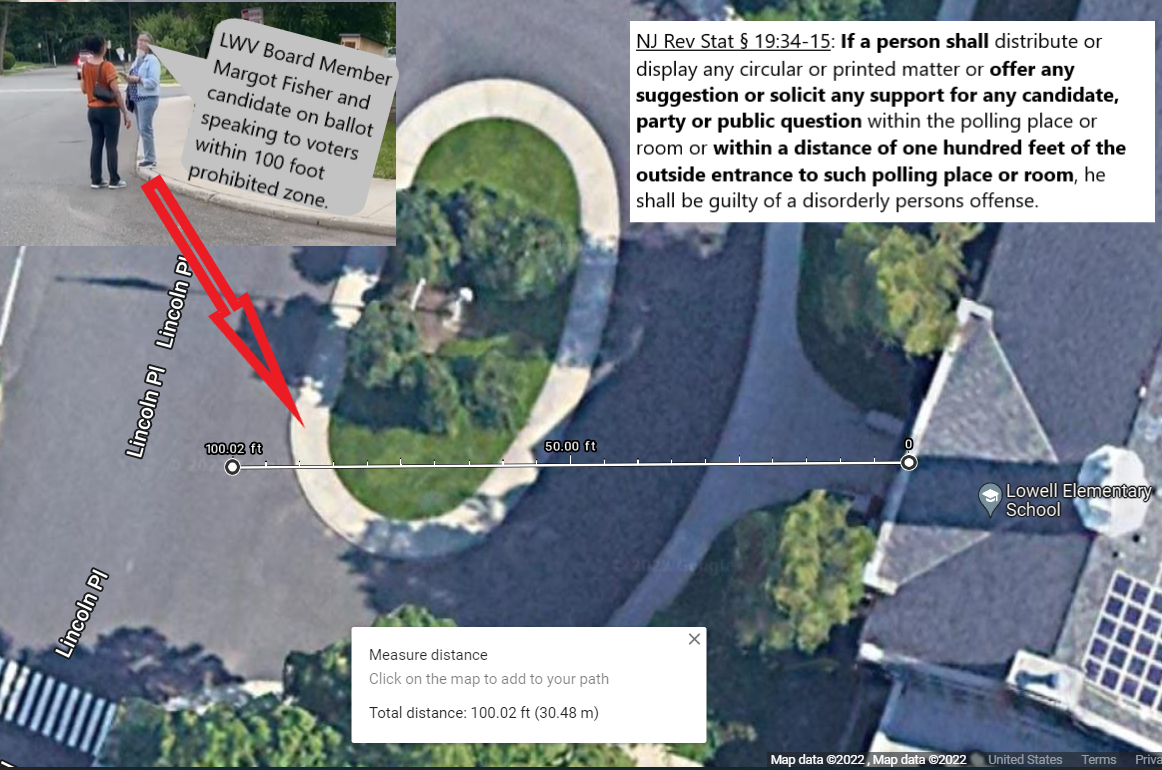

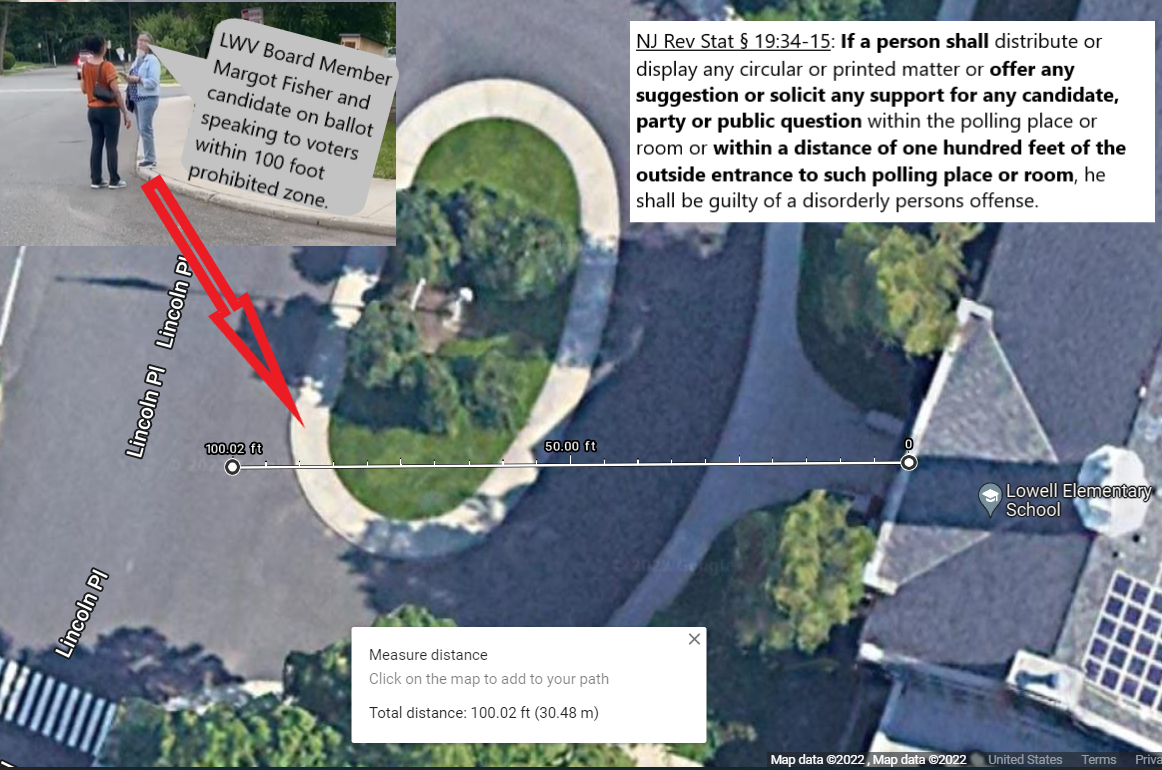

Because this actually *IS* a violation of NJ Election Law, only it’s not Kaplan violating it. It’s LWV board member, Margot Embree Fisher (who was on the ballot that day, too!

Watch Margot Embree Fisher chatting up voters on the way in to vote IN THE PROHIBITED ZONE, in the district where she was on the ballot:

But there was an allegation that someone else did the bad stuff. Who made that allegation?

From the police report filed by Officer Apreda that day:

Officer Apreda responded to the polling place after police dispatch fielded a telephone call from a concerned resident who reported harrassment occurring within the polling location. The caller, Margaret Fisher, was not located upon Officer Apreda’s arrival.

and

Shortly thereafter, I contacted Ms. Fisher via telephone. She informed me that she did not observe any acts of harassment or electioneering. She stated that she heard of Mr. Kaplan’s presence at the Rodda Center from an unidentified third party, and contacted headquarters because she was concerned that he would engage in these acts based on her estimation of his past history. I advised Ms. Fisher, who wished to retract her involvement, that any witnesses or victims of the alleged acts could contact the police department.

Got it – so the person doing actual violations called in a report to send armed agents of the State to attack someone who campaigns against her.

I join the LWVT’s call for routing out election law scofflaws. But you might want to look in your own ranks, first.

Like I said: It’s silly season.

Letter from LWV to Bergen County: